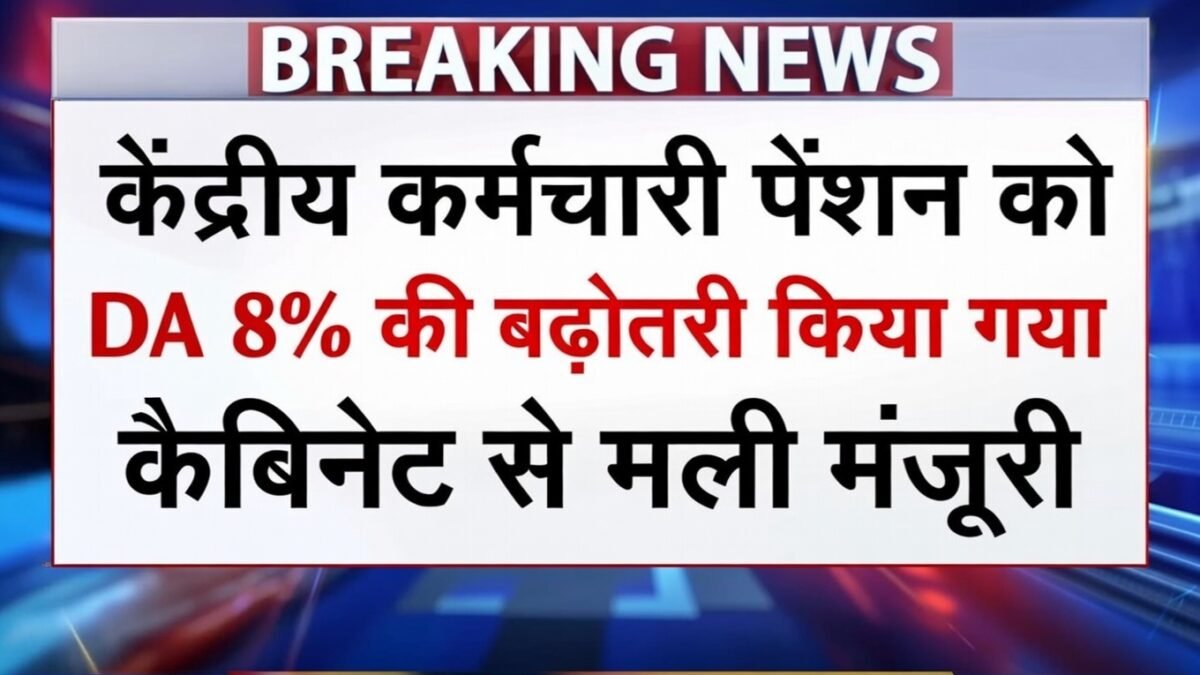

In a major development that has brought relief and excitement among government employees and pensioners, reports suggest that the Cabinet has cleared an 8% Dearness Allowance (DA) increase. If implemented as expected, this move could significantly raise monthly salaries and pensions, helping millions cope with rising inflation and cost of living pressures. While official notifications are awaited, the announcement itself has already become a hot topic across offices, unions, and retiree groups.

Dearness Allowance plays a crucial role in protecting incomes against inflation, and an 8% hike is considered one of the more substantial increases in recent years. For many families dependent on government salaries or pensions, this decision could mean better financial breathing space in 2026.

What Is Dearness Allowance and Why It Matters So Much

Dearness Allowance is a cost-of-living adjustment paid to central and state government employees and pensioners. It is revised periodically based on inflation data, primarily the Consumer Price Index (CPI). The main purpose of DA is to ensure that inflation does not erode the real value of salaries and pensions.

Over time, DA becomes a significant component of total earnings. Any increase, especially a large one like 8%, directly boosts take-home pay and pension amounts. This is why DA announcements are closely followed and widely discussed.

Details of the Reported 8% DA Increase

According to reports circulating in policy and employee circles, the Cabinet has approved an 8% DA hike, which would be applicable to both serving employees and pensioners. If confirmed, this increase would be added to the existing DA rate, pushing the overall percentage to a new high.

Such a jump is being seen as a response to sustained inflation levels and rising prices of essential goods, including food, fuel, housing, and healthcare. An 8% increase indicates that the government acknowledges the pressure on household budgets and is taking steps to address it.

Who Will Benefit from the DA Hike

The proposed DA increase is expected to benefit:

- Central government employees across all pay levels

- Pensioners and family pensioners

- Employees of autonomous bodies that follow central DA patterns

In total, more than one crore beneficiaries could see a direct financial impact once the hike is officially implemented.

How Much Will Salary Increase After 8% DA Hike

The actual increase in salary depends on an employee’s basic pay. DA is calculated as a percentage of basic pay, so higher basic pay means a higher DA amount.

For example, if an employee has a basic pay of ₹25,000, an additional 8% DA would translate into an extra ₹2,000 per month. For someone with a basic pay of ₹50,000, the increase would be ₹4,000 per month. This rise comes without any additional deductions, making it a direct benefit.

Impact on Pensioners and Retirees

Pensioners are among the biggest beneficiaries of DA hikes because DA is added directly to their monthly pension. For retirees living on fixed incomes, rising expenses often create financial stress, and DA increases help maintain dignity and stability.

An 8% DA hike could significantly improve monthly pension payouts, especially for those drawing minimum or mid-level pensions. It may also positively impact family pensioners who rely solely on pension income.

DA Arrears: Will Employees Get Backdated Payments

One of the most common questions after any DA announcement is about arrears. If there is a gap between the effective date and the payment date, employees and pensioners usually receive arrears for the delayed period.

If the 8% DA hike is implemented retrospectively, beneficiaries could receive a lump-sum arrears payment along with the revised salary or pension. This one-time amount often provides additional financial relief.

How This DA Hike Connects to the 8th Pay Commission

The timing of this DA increase is particularly important because discussions around the 8th Pay Commission are already underway. Historically, when DA reaches higher levels, the government considers merging a portion of it into basic pay during the next pay commission.

If DA continues to rise and touches key thresholds, it could influence the structure and recommendations of the 8th Pay Commission, potentially leading to higher basic pay and long-term benefits.

Economic Impact of an 8% DA Increase

Beyond individual households, a large DA hike also impacts the broader economy. Higher disposable income among government employees and pensioners can lead to increased spending, boosting demand in sectors like retail, housing, healthcare, and services.

At the same time, the government must balance fiscal discipline with social responsibility. An 8% increase suggests that authorities are confident about managing the financial impact while supporting income stability.

What Employees Should Do Now

While the news has created optimism, employees and pensioners should wait for the official government notification for final confirmation. Until then, it is wise to:

- Avoid making financial commitments based solely on estimates

- Keep track of official press releases and orders

- Use updated salary calculators once the DA rate is formally announced

Being informed and cautious ensures better financial planning.

Final Words

The reported clearance of an 8% DA increase by the Cabinet is being seen as a strong and positive step for government employees and pensioners. If officially confirmed, it would not only raise monthly income but also signal the government’s intent to protect livelihoods amid economic challenges.

As the final announcement approaches, expectations are high. For millions of families, this DA hike could make a meaningful difference in daily life, savings, and overall financial security in 2026.